Broadcom stock price has done well this year, helped by the ongoing AI tailwinds that have turned it into a $1.57 trillion juggernaut. It has jumped by 160% from its lowest level in April when Donald Trump unveiled his reciprocal tariffs. AVGO now trades at $358, a few points below the all-time high.

AVGO business is thriving

Broadcom is one of the biggest companies globally, thanks to its diverse products and services that span across different industries. It is a major provider of semiconductor solutions, including in areas like wired and wireless communications.

The company also offers storage and systems, and optical and motion solutions to some of the biggest companies in tech. For example, it has a multi-billion-dollar deal with Apple, where it provides wireless solutions found on its iPhones.

The company also offers other solutions, including infrastructure software, including its VMware portfolio, mainframe solutions, and cybersecurity. It has created these businesses through giant acquisitions, including the $69 billion buyout of VMware, $18 billion of CA Technologies, $10.7 billion of Symantec, and $5.9 billion of Brocade.

Broadcom’s business has been in a strong trajectory this year, helped by its AI solutions. These tailwinds intensified recently when it announced a giant partnership with OpenAI.

This deal will create 10 gigawatts of custom AI and will be implemented beginning late 2026 and full rollout happening at the end of 2029. In their statement, OpenAI will design the AI accelerators and system architecture and Broadcom will manufacture them.

The deal is important because it may help it attract more clients in the AI space, including popular names like Anthropic and xAI. It will also be a high-margin business, and the company has hinted of a $10 billion order with a mystery client.

Broadcom revenue and profit growth

The most recent results showed that Broadcom’s business brought in $15.95 billion in revenue in the third quarter. This revenue was up by 22% from what it made in the same period last year.

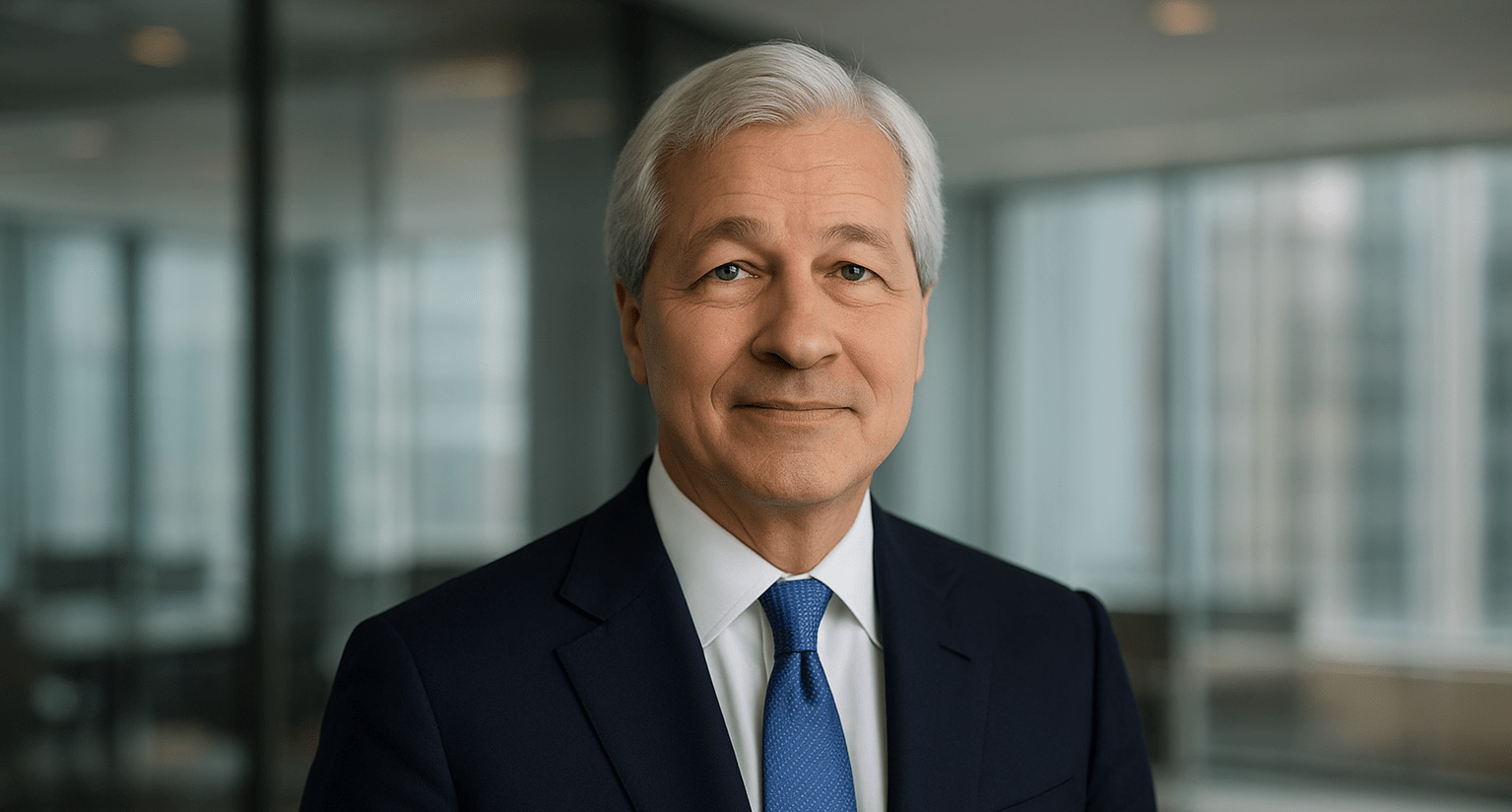

Broadcom’s net income jumped to over $4.1 billion, while its adjusted EBITDA jumped to $10.7 billion. This figure is notable as it represented about 67% of its total revenue. Hock Tan, the CEO, noted:

“We expect growth in AI semiconductor revenue to accelerate to $6.2 billion in Q4, delivering eleven consecutive quarters of growth, as our customers continue to strongly invest.”

Broadcom has also continued to return cash to investors through dividends, paying $2.8 billion in the last quarter.

Still, analysts believe that Broadcom’s business will continue doing well. The expectation is that its revenue will grow by 24% to $17.46 billion. This growth will bring its annual revenue figure to $63 billion, up by 22% from the same period last year.

Still, the biggest concern about Broadcom is that it is a highly expensive company. Its forward price-to-earnings ratio is 82.6, much higher than the sector median of 32. Its forward PEG ratio is 1.75, higher than the five-year average of 1.45.

Its valuation metrics are also higher than those of other faster-growing companies like Nvidia.

Broadcom stock price technical analysis

The daily timeframe chart shows that the AVGO stock price peaked at $386 and then pulled back to $358. It has remained significantly above the 50-day and 100-day moving averages.

Broadcom stock has formed a double-top pattern at $372 and a neckline at $324, its lowest point in October. It has also formed an island reversal pattern.

Therefore, the most likely scenario is where it resumes the downtrend and retest the neckline at $324 ahead of its earnings in December. A move above the year-to-date high of $385 will invalidate the bearish view.

The post Is the expensive Broadcom stock a good buy today? appeared first on Invezz